Florida lawmakers have negotiated a nearly $1.3 billion tax package for next fiscal year that includes expanding popular shopping sales tax “holidays,” trimming a commercial lease tax and cutting costs of diapers for babies and adults.

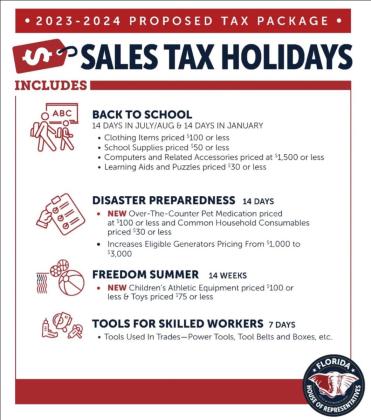

The package, in part, includes a series of bulked-up tax holidays. That includes holding two back-to-school tax holidays, after holding one holiday in past years. The bill would allow shoppers to avoid paying sales taxes on clothes costing $100 or less, school supplies priced at $50 or less and personal computers that cost $1,500 or less. The holidays would be held from July 24 to Aug. 6, and again from Jan. 1-14 and are projected to save shoppers $160.6 million.

To help people prepare for the hurricane season, the bill would provide sales-tax exemptions on certain storm supplies, a variety of household goods, pet food and pet medication. The breaks would be offered around the start of hurricane season, from May 27 to June 9, and again near the traditional peak of the season, from Aug. 26 through Sept. 8.

Meanwhile, the bill would expand an effort from the past couple of years aimed at providing sales-tax exemptions around the July 4 holiday. The bill includes what is dubbed “Freedom Summer” from Memorial Day through Labor Day. Exemptions during the period would be provided on such things as tickets to movies, live musicals and sporting events, entry to state parks, children’s athletic equipment and supplies for home pools, boating, camping and fishing. That part of the package would reduce state and local taxes of $229.9 million.

A fourth tax holiday would provide exemptions on power tools and work gear over the Labor Day weekend.

A House staff analysis projected the trust fund would be made whole in May 2024. That would lead to reducing the commercial-lease tax to 2 percent starting Aug. 1, 2024.

The bill also would permanently provide tax exemptions for diapers and incontinence products, baby and toddler items, oral hygiene products, renewable natural-gas equipment, cattle fencing and firearm storage devices.

The package also included a Senate request for $25 million in tax credits on brownfield site cleanup projects.